do you pay taxes when you sell a car in illinois

In addition to the above sales tax can also be charged on a county or municipal level. The trade off to eliminate the tax cap was to slightly increase the tax on private car sales.

Nj Car Sales Tax Everything You Need To Know

What is my tax obligation when I apply for title in Illinois.

. Iowa collects a 5 state sales tax rate as a One-Time Registration Fee on the purchase of all vehicles. Who Pays Sales Tax. Remove the License Plates.

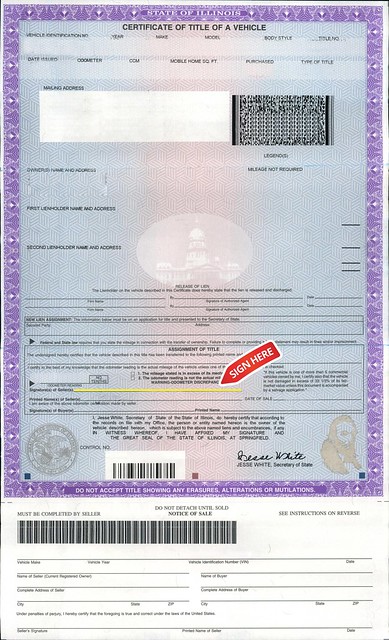

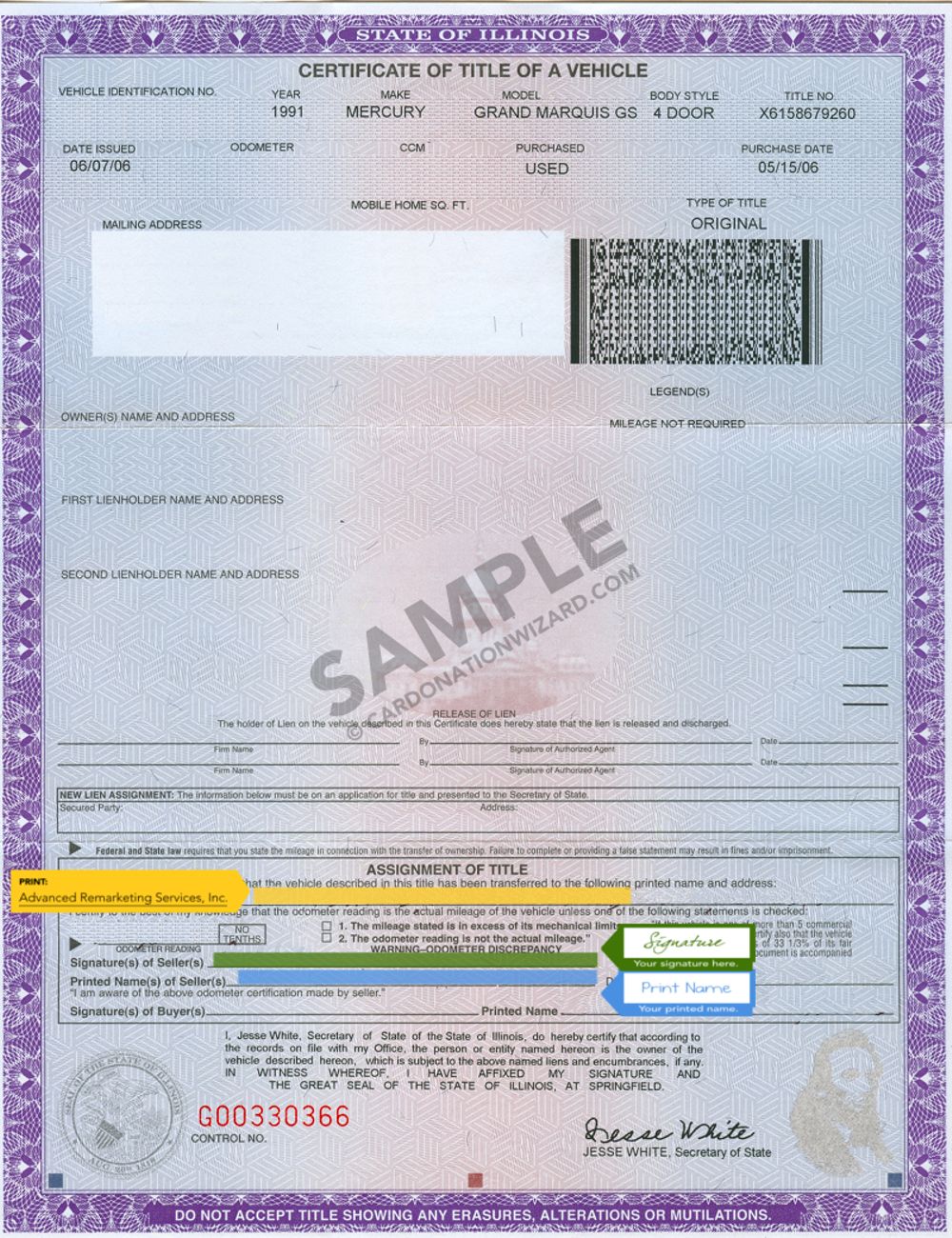

To legally transfer the car you must sign the title over to the buyer. The state sales tax on a car purchase in Illinois is 625. Collect Payment from the Seller.

The sales tax on a new car might be 5. Illinois tax on new and used vehicles is generally 625 but can vary by location. In Oklahoma the excise tax is.

The short answer is maybe. If youre buying a new or used car its important to know the taxes and fees you may have to pay. In addition to state and county.

The buyer is responsible for paying the sales tax. So if you bought the car for 14000 and sold it for 8000 you would have a capitol loss of 6000. There is also between a 025 and 075 when it comes to county tax.

The amount that you have to pay for your Illinois used car sales tax or your Illinois new car sales tax depends on what city you live in. However there WILL be an audit by the Illinois Department of. When you purchase a vehicle through a private sale you must pay the associated local and state taxes.

You do not need to pay sales tax when you are selling the vehicle. You do not need to pay sales tax when you are selling the vehicle. If you spend 7000 on a car and an additional 1000 on improvements but you sell the car for 7000 its considered a capital loss and you dont need to pay tax on the sale.

Even in the unlikely event that you sell your private car for more than you paid for it special. Since the Missouri tax appears to be 4225 and the standard Illinois tax on vehicle sales is 625 you must pay the 2025 difference. There are some circumstances where you must pay taxes on a car sale.

Even if you purchased your new car in a different state you. In most states youll need to bring your Bill of Sale and signed title to the. Thankfully the solution to this dilemma is pretty simple.

Illinois collects a 725 state sales tax rate on the purchase of all vehicles. Subtract what you sold the car for from the adjusted purchase price. Unless of course you.

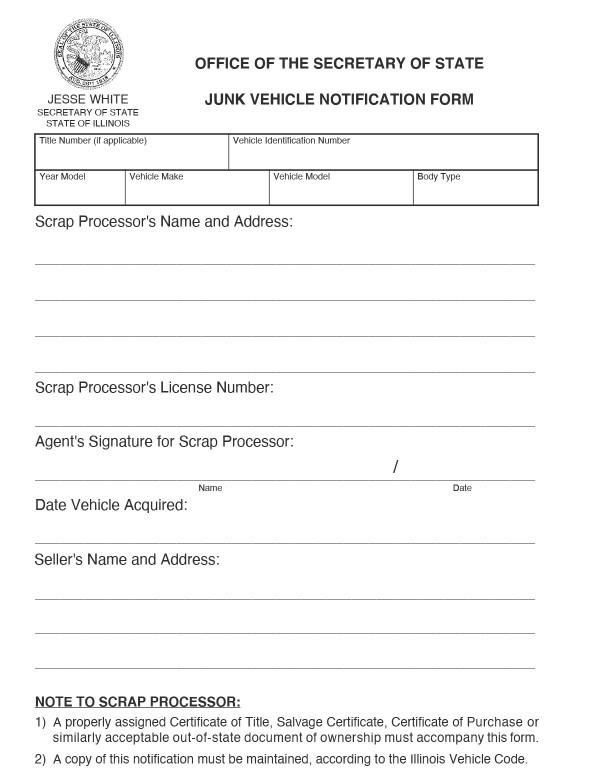

The following applies to sales between private individuals. Answered by Edmund King AA President. If you sell a 2017 Mercedes and claim a sale price of 15000 or less you will have to pay tax on the 15000 or less val-uation.

In case you were wondering 742 of 37851 is around 2808. Some states such as California charge use taxes when you bring in a car from out-of-state even if youve already paid the sales tax on the vehicle. You dont have to pay any taxes when you sell a private car.

Prepare Bills of Sale for Both Yourself and for the Buyer. However you do not pay that tax to the car dealer or individual selling the car. What is the sales tax on a car purchased in Illinois.

Thats 2025 per 1000. Although a car is considered a capital asset when you originally purchase it both state. In addition to taxes car purchases in Iowa may be subject to other.

The process is different for sales made by car dealers. Do you have to pay tax if you sell a car. At the time you apply for an Illinois title with the Secretary of State for a vehicle you purchased leased or acquired by gift or transfer.

Sign Over the Title. The average local tax rate in Illinois is 1903 which brings the.

Donate Car Il Car Donation Illinois Kars4kids

How To Gift A Car A Step By Step Guide To Making This Big Purchase

Buying From A Private Seller Vehicle Registration Titling And Fees Explained

Used Cars In Illinois For Sale Enterprise Car Sales

Used Cars In Illinois For Sale Enterprise Car Sales

Illinois Used Car Taxes And Fees

Updates To The 2022 Illinois Trade In Tax Credit Castle Chevrolet

Illinois Bill Of Sale Forms And Registration Requirements

Taxes When Buying A Car Types Of Taxes Payable On A Car Purchase Carbuzz

Illinois Bill Of Sale Form Dmv Il Information

What Is Illinois Car Sales Tax

How To Get The Best Offer For Your Trade In News Cars Com

Ebay Or Etsy Sale Of 600 Now Prompt An Irs Form 1099 K Money

Why You Might Pay More To Buy A Car In Illinois A Trade In Tax Credit Cap

How To Charge Sales Tax In The Us A Simple Guide For 2022

How To Sell A Car In Illinois Metromile